We closed our covered call on CFG today. When we opened the position on 1/26 our goal was to capture the $.39 x 500 shares dividend ( x-div on 2/20). We made a small profit on the covered call ($140). We pick up an additional $195 in profit when the dividend is paid for a total profit of $335. Our investment for the covered call was $19,600 (Cost of stock minus option premium received). ROI was 1.7% in 13 days or 47.8% annualized.

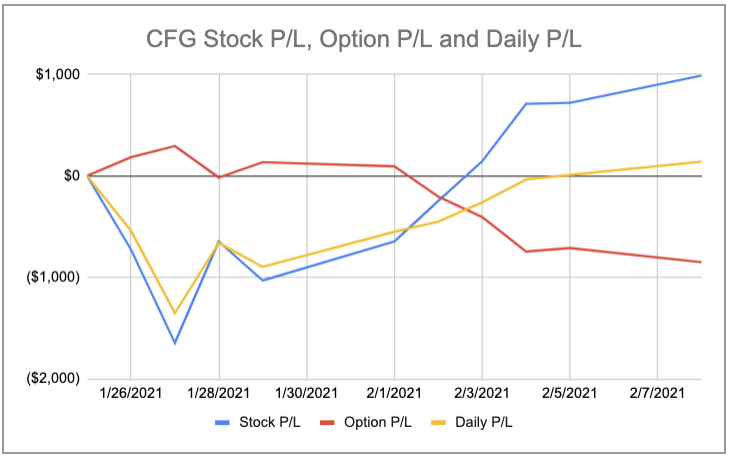

The graph below shows the daily profitability of the position. Share prices fell immediately after we established the position. As the stock recovered the net daily profit of the covered call (yellow line) improved. We started making money on the covered call on Feb.5.

We closed the position down to decrease our margin in the account. On Friday we “rolled up” a lot of stock which increased the margin to an uncomfortable level.